Written by Alec Gain & Rana Hamdy,

Reporting from Nelson High School, Burlington, Ontario.

On Friday, April 1st 2016 the nation of Mountain Dew was enthralled by a court case between two of its most prominent citizens.

On Friday, April 1st 2016 the nation of Mountain Dew was enthralled by a court case between two of its most prominent citizens.

The accuser, David.Sanders took local farmer Anna Ljungberg to court, where he accused her of violating the constitution and doing him personal damage in the process. “I feel my rights have been violated.” Said David. “And I will not stand for this.” He decided to sue and sought $2500 and a free yearly food unit as compensation.

The accused, Ms.Ljungberg, seemed extremely calm and unaffected by the accusations against her. “I think it’s pretty funny that he’s trying to sue, he has no evidence and I have nothing to be afraid of.”

However Dave’s Lawyer, Mac Fletcher, was extremely confident about this case and said that all they wanted was justice for the people of Mountain Dew. And he was sure they would get it.

Dave sued Anna on the grounds that she had sold him a food unit for $600. Which was more than double what the constitution allowed her to charge. He claimed that due to this unfair treatment he did not have enough money to buy other necessities. Additionally, he claimed Anna had egregiously violated the nation’s constitution and laws. His intrepid lawyer shocked everyone with the amount of evidence they had compiled for their suit, which included screenshots of the trades that had taken place.

Despite the overwhelming evidence the prosecution had assembled. Anna pleaded not guilty. She said that it was her own private business and she could do as she pleased. She also mentioned that in the beginning Dave offered her a smaller amount, and when she elected to reject it, he increase the offer. She claimed it was her right to refuse to sell to him, and his fault for offering her more money.

Despite the overwhelming evidence the prosecution had assembled. Anna pleaded not guilty. She said that it was her own private business and she could do as she pleased. She also mentioned that in the beginning Dave offered her a smaller amount, and when she elected to reject it, he increase the offer. She claimed it was her right to refuse to sell to him, and his fault for offering her more money.

After much debate, prosecutor Kirby. Allen declared. “She was ill prepared for this case, she will have to pay a 750$ fine to Dave and another $250 fine to the government due to her lying”. Ms.L agreed to all the terms.

We are proud to announce that users can now access the PDF versions of the published CM Manuals on civicmirror.com. Whereas before users could only make copies of the Draft Manuals, from the Getting Started page, links to the super synchronized and awesome versions of the manuals are available.

We are proud to announce that users can now access the PDF versions of the published CM Manuals on civicmirror.com. Whereas before users could only make copies of the Draft Manuals, from the Getting Started page, links to the super synchronized and awesome versions of the manuals are available.

There were accusations made: the Prime Minister was accused of giving people the password, the three apartment owners were accused of planning to kick everyone out of their apartments so people would die, and another accusation that someone given the government password was offering to sell it. A pretty rough start to the Conservative’s reign in power.

There were accusations made: the Prime Minister was accused of giving people the password, the three apartment owners were accused of planning to kick everyone out of their apartments so people would die, and another accusation that someone given the government password was offering to sell it. A pretty rough start to the Conservative’s reign in power.

Despite the overwhelming evidence the prosecution had assembled. Anna pleaded not guilty. She said that it was her own private business and she could do as she pleased. She also mentioned that in the beginning Dave offered her a smaller amount, and when she elected to reject it, he increase the offer. She claimed it was her right to refuse to sell to him, and his fault for offering her more money.

Despite the overwhelming evidence the prosecution had assembled. Anna pleaded not guilty. She said that it was her own private business and she could do as she pleased. She also mentioned that in the beginning Dave offered her a smaller amount, and when she elected to reject it, he increase the offer. She claimed it was her right to refuse to sell to him, and his fault for offering her more money. In Ms. Leslie Knowles Civic Mirror classroom at Nelson High School, in Burlington, Ontario, terror has struck in the nation of “Mountain Dew”. Reportedly, a man only known by the moniker “Wrath” attempted to spark Nation-wide fights by turning students on each other. His method of doing so? Threatening to reveal a hidden agenda.

In Ms. Leslie Knowles Civic Mirror classroom at Nelson High School, in Burlington, Ontario, terror has struck in the nation of “Mountain Dew”. Reportedly, a man only known by the moniker “Wrath” attempted to spark Nation-wide fights by turning students on each other. His method of doing so? Threatening to reveal a hidden agenda.

* * *

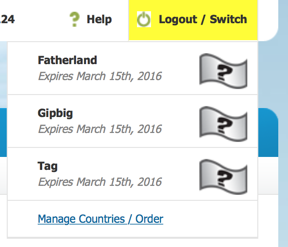

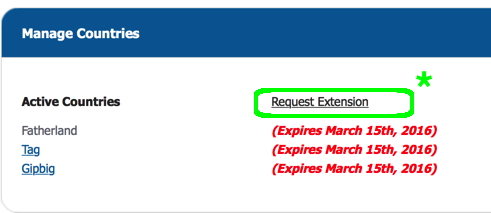

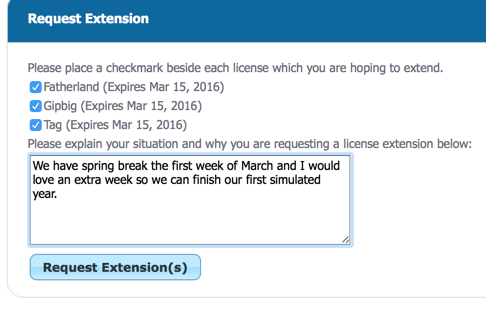

* * * Civic Mirror allows teachers to turn the social studies classrooms into countries and their students into citizens. For teachers running multiple classes, our “Country Switch / Logout” menu has allowed teachers to toggle between their classes. For long-time users, however, the list of CM Countries was becoming way too long as it displayed all countries from years past.

Civic Mirror allows teachers to turn the social studies classrooms into countries and their students into citizens. For teachers running multiple classes, our “Country Switch / Logout” menu has allowed teachers to toggle between their classes. For long-time users, however, the list of CM Countries was becoming way too long as it displayed all countries from years past.

After the President of the Republic of Vendette earlier today showed great disrespect to the United Tribes of Kevron, the country decided to respond in the form of war. The United Tribes of Kevron state that their demands listed on the document were for the better of both countries so that both could prosper.

After the President of the Republic of Vendette earlier today showed great disrespect to the United Tribes of Kevron, the country decided to respond in the form of war. The United Tribes of Kevron state that their demands listed on the document were for the better of both countries so that both could prosper.